As the sun rises over the vibrant streets of Bali, a new initiative is stirring among the tourism officers of the island. From bustling markets to pristine beaches, officers are conducting spot checks to ensure visitors are compliant with the recently implemented tourism tax. This tax, aimed at preserving the natural beauty and cultural heritage of Bali, has sparked both controversy and support among tourists and locals alike. Join us as we delve into the world of Bali tourism tax spot checks and explore the impact it is having on this beloved Indonesian destination.

Enhancing Revenue Collection Strategies in Bali

Authorities in Bali have recently implemented a new strategy to enhance revenue collection for the tourism industry. Officers have been conducting spot checks at popular tourist destinations to ensure that visitors are paying the required tourism tax. This initiative aims to increase compliance with the tax regulations and generate more revenue for the local government.

The spot checks have been met with mixed reactions from tourists, with some appreciating the efforts to support the local economy, while others have expressed frustration at the additional costs. To avoid any confusion, it is important for tourists to be aware of the tourism tax requirement and prepare accordingly. Compliance with the tax not only benefits the local community but also contributes to the sustainability of the tourism industry in Bali.

Ensuring Compliance with Tourism Tax Regulations

Officers from the local tourism authority in Bali have been conducting surprise spot checks at various tourist establishments to ensure compliance with the tourism tax regulations. The aim of these checks is to verify that businesses are correctly collecting and remitting the required taxes from tourists visiting the island.

During these spot checks, officers are inspecting documents, such as receipts and invoices, to confirm that the correct amount of tourism tax has been charged to customers. Business owners found to be in violation of the regulations may face fines or other penalties. It is important for all establishments to adhere to these regulations to support the local tourism industry and contribute to the sustainable development of Bali’s tourism sector.

Impact of Spot Checks on Local Businesses

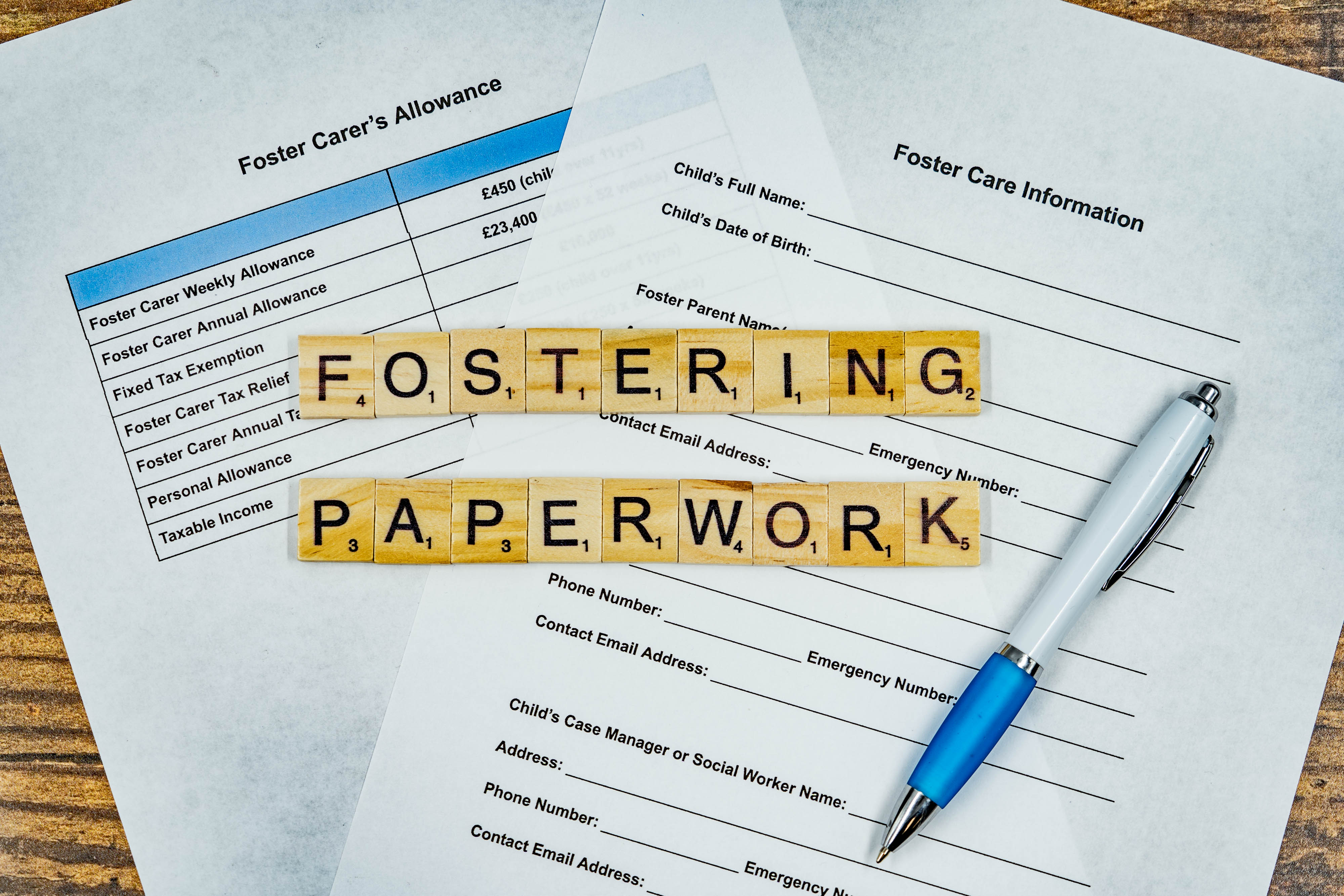

Officers in Bali have recently been conducting spot checks on local businesses to ensure compliance with the new tourism tax regulations. These spot checks have had a significant impact on the local businesses, with many reporting increased pressure to meet the tax requirements. Some businesses have found themselves struggling to keep up with the additional paperwork and financial burden that comes with the new regulations.

One of the main challenges faced by local businesses is the unpredictability of these spot checks. With officers showing up unannounced, businesses have been left scrambling to make sure they are in compliance. This has led to increased stress and anxiety among business owners, who fear the consequences of non-compliance. Overall, the spot checks have created a sense of unease within the local business community, as businesses strive to navigate the new regulations and avoid penalties.

Fostering Transparency and Accountability in Tax Enforcement efforts

Officers from the tax enforcement department recently conducted spot checks at various tourist locations in Bali to ensure compliance with the tourism tax regulations. These surprise visits were part of a larger effort to foster transparency and accountability in tax enforcement efforts, as well as to crack down on tax evasion in the tourism industry.

The spot checks involved inspecting businesses that cater to tourists, such as hotels, restaurants, and tour operators, to ensure that they were properly collecting and remitting the tourism tax. Any businesses found to be in violation of the regulations were subject to fines and penalties. By conducting these spot checks, the tax enforcement department aims to send a clear message that compliance with tax laws is non-negotiable, and that those who attempt to evade their tax obligations will be held accountable.

As officers continue to conduct spot checks for Bali tourism tax, travelers are reminded of the importance of complying with local regulations to support the sustainable development of the island. By paying the tourism tax, visitors can contribute to the preservation of Bali’s cultural and natural heritage for future generations to enjoy. Let’s all do our part to ensure the beauty of Bali remains for years to come. Thank you for reading.